At the Sustainable Packaging Coalition, we know that no one company can overcome all the challenges in our current plastic film recycling landscape. Industry collaboration and system transformation will be essential — and that transformation starts with evaluating the evolving scenarios and finding ways to strategically adapt to them.

Today, we’re excited to share our North American Film Recyclers Analysis and Dashboard, which comprehensively analyzes the landscape and limitations of film recycling across the U.S. The Dashboard provides SPC members with data, insights, and tools needed to improve circularity for films across the U.S.

In this post, we’ll cover:

- The Current State of Plastic Film Recycling

- Systemic Limitations Across the Film Recycling Ecosystem

- Paths for Action: How SPC Members Can Get Involved

—

The Current State of Plastic Film Recycling

The plastic film recycling industry in the U.S. and Canada is at a crossroads. Amid growing scrutiny and declining trust in film recycling, our industry needs to produce data and take action to substantiate plastic film recycling.

Right now, film recycling in the U.S. is imperfect. In an ideal world, films would be recyclable curbside; however, right now, film recycling relies heavily on consumer participation in the Store Drop-off (SDO) systems provided by retailers. To better understand how we could improve the current system, the Sustainable Packaging Coalition (SPC) conducted interviews with retailers running Store Drop-off programs and identified two critical areas for improvement:

- Expanded local infrastructure for film recycling. Right now, film recycling largely depends on a handful of national film recyclers. Going forward film recycling could benefit from having local or regional recyclers to process these films to cut down on costs, support local economies, and reduce the impacts of transportation.

- Increased demand for recycled films. If companies can increase their demand for recycled films and create new end-markets for recycled film that includes packaging applications, we can better incentivize store collection and achieve better supply-demand balance.

To address these areas of improvement, SPC has developed the North America Film Recyclers Analysis and Dashboard. The Dashboard provides a comprehensive analysis based on data subscribed from the ICIS Recycling Supply Tracker. Quantitative data has been complemented with qualitative data from interviews with key film recyclers and other industry experts. Data insights reveal a landscape with systemic limitations.

To access our North America film Recyclers Analysis and Dashboard, SPC members can visit the Dashboard in their Member Platform.

—

Systemic Limitations Across the Film Recycling Ecosystem

What are the limitations in film recycling infrastructure?

- Limited recycling capacity and production

Recycling capacity is defined as the maximum input of plastic waste that the plants can potentially process, and production means the volume of recycled pellets or flakes produced by recyclers.

According to the ICIS Recycling Supply Tracker, the current plastics recycling capacity in North America (U.S., Canada, and Mexico) is 9.5 million tons per year. This capacity includes the following resins: Polyethylene (PE), Polyethylene Terephthalate (PET), and Polypropylene (PP). Feedstock sources include both Post-Consumer Resin (PCR), and Post-Industrial Resin (PIR) and both rigid and flexible plastics, of all colors.

Recycled resin production in North America is currently 4.2 million tons per year which, according to ICIS Analysts, represents only 13% of the total consumption of PE, PET, and PP, including both virgin and recycled materials.

In other words, there’s a large gap between consumption of these materials and recyclers’ capacity to recycle them.

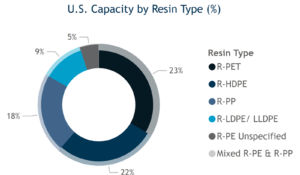

- Minimal share of capacity for R-LDPE & LLDPE PCR

In the U.S., just 9% of the country’s total plastic recycling capacity is dedicated to Recycled Low Density Polyethylene (R-LDPE) and Recycled Linear Low Density Polyethylene (R-LLDPE) — the materials that make up most plastic films and flexible packaging.

If we look at the capacity to recycle Post-Consumer Resin (PCR), the volumes are even more restricted. And because Store Drop-off (SDO) materials are classified as PCR, this underscores the importance of tracking this material source throughout the analysis presented in this article.

Data Source: ICIS Recycling Supply Tracker – Mechanical; Analysis: SPC

- Film recycling capabilities

While it’s unclear how much of the U.S. plastic recycling capacity is specifically used for Recycled Polyethylene (R-PE) film, we can estimate the potential by looking at which facilities have the capability to possibly process film

According to SPC analysis, only 45% of the R-PE facilities, which include both R-HDPE, and R-LDPE & LLDPE, have the capability to process film.

Additionally, having the capability to process film doesn’t mean that recyclers actually will actually reprocess the material or plan to do so. Under current end market conditions, it’s difficult to imagine recyclers switching from rigid to flexible plastics.

- Limited geographical reach across North America

Analysis of the R-LDPE and LLDPE PCR recyclers map shows that the recyclers have a limited geographical reach across North America. While plastic films and flexible packaging are consumed throughout the region, recycling facilities are concentrated in a few regions, including the Eastern U.S.

This geographical restriction causes logistical challenges in an already difficult value chain, impacting both environmental and economic aspects.

- Low overall production yields

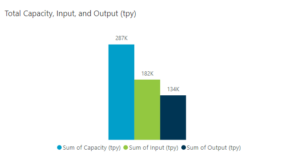

Data from the ICIS Recycling Supply Tracker shows a significant gap between plants’ capacity (the maximum input that the plants can potentially process), and their actual input volume.

Output volume is the production of recycled resins available to be used for new applications in the market. In addition to a gap in recycling capacity, there are also material losses throughout reprocessing that reduce the output volume of recycled resins.

Data Source: ICIS Recycling Supply Tracker – Mechanical; Analysis: SPC

- Slow-paced collaboration among existing recyclers

Discrepancies among recyclers in terms of the number of locations, plant sizes, utilization rates, and yields indicate a lack of collaboration within the industry. There is a great opportunity for recyclers to learn from each other and improve the reprocessing of these materials from a systemic level.

What’s causing these limitations in film recycling infrastructure?

- Insufficient supply and contamination issues

During industry interviews, we learned that the most pressing issue is that recyclers don’t have a sufficient supply of quality Polyethylene (PE) film waste to reprocess.

Recyclers consistently report that available PE film waste bales do not meet the quality standards required for recyclers to produce recycled resins to be made into flexible packaging again. Feedstock contamination is a real issue, especially when waste is coming from front-of-house Store Drop-off bins. While recyclers are able to process steady streams of similar materials, they are not able to process mixed and contaminated materials.

- Technical challenges

Multiple technical obstacles to recycling films persist, including:

- Contamination from other plastic resins or materials

- Contamination from printing

- Quality issues with Post-Consumer Resin (PCR)

- Difficulties processing lightweight and multi-material films

- Quality issues in recycled films, such as discoloration, low puncture resistance, and gel formation

- Economic barriers

The economics of recycling remain challenging. Virgin resin is abundant, and continues to be less expensive than recycled resin, making it difficult for recycled resins to compete. Limited capacity for film recycling and high costs of logistics and production create significant roadblocks for the scale and economic viability of recycled resins.

- Market hesitation

Brands demonstrate a cautious approach to increasing recycled content, particularly in sensitive applications like flexible food packaging. In our interviews, we often found that professionals find themselves looking for other companies to take the first step and set an example on how to better integrate recycled films; however, this hesitation hinders meaningful progress.

—

A Call to Action: What Can SPC Members Do?

To SPC members – brand owners, retailers, recyclers, converters, and other industry stakeholders: we’ll need cross-industry collaboration to improve film recycling infrastructure.

SPC is working to improve film collection and reprocessing through its Collaboratives — and if you’re interested in getting involved, please reach out to SPC’s Paula Leardini at paula.leardini@greenblue.org.

Three Recommended Actions For Enhancing Collaboration

1. Infrastructure: Improved film recycling infrastructure

Recyclers and technology providers can collaborate to improve production yields in film recycling facilities, increasing output volumes (or production) of recycled resins without investment in new capacities.

Converters and brands can partner with recyclers to find new film recycling capacities and effectively increase demand for these materials. Both mechanical and chemical recycling approaches may be considered, where legislation allows.

2. Supply: Enhanced collection and sorting

To increase the amount of input volumes in recycling facilities — without requiring new facility investments — there’s a need for higher-quality film bales.

To do this, all industry stakeholders can collaborate to educate consumers about proper film collection and recycling practices through the Store Drop-off system.*

Brands and retailers can also join forces with recyclers to explore possibilities for aggregating and sorting films to be used as feedstock for recycling. Long-term contracts among parties are also encouraged.

3. Demand: Building momentum with other recycled film resins

To build momentum for recycled resins, film recyclers recommend starting with retailers’ back-of-house films, which are typically cleaner and higher quality than front-of-house films. Focusing on these easier-to-recycle materials first can help build the necessary infrastructure and momentum before tackling more complex sources, such as consumer-facing front-of-house film

Brands can take the first step toward integrating PCR into their portfolios, determining for example when they can use back-of-house PCR films, or where they can use food-grade PCR films. These efforts can help improve infrastructure for all film recycling.

Brands can also work with consumers on the acceptance of different aesthetics of packaging made with recycled content.

Recyclers can support this approach by collaborating with brands on product development and long-term supply agreements.

Conclusion

The path to improving plastic film recycling won’t be paved by perfection at every step — it will require persistent, strategic adaptation across our industry. Through SPC’s SDO Film Recovery Collaborative, our goal is to facilitate collaboration and make progress in the film recycling industry.

Alongside our 280 participating Collaborative members from companies across the value chain, we will continue to embrace collaboration. And if we succeed, we can overcome systemic limitations and increase plastic film recycling that reduces plastic pollution, increases film circularity, and helps us meet our long-term sustainability commitments.

*SPC is leading a research initiative to better understand consumer awareness around SDO film programs to be presented to SPC members in Fall 2025. Once results are out, we will facilitate a plan of action with members, including brands and retailers, aiming to increase consumer education.